Introduction

After a startup successfully raises its first funding, it moves to Series A. It is the first major venture capital (VC) round designed to scale operations and expand market reach. Reaching Series A is a tremendous milestone for any startup. Looking for practical insights on this specific round?

Here is a breakdown of Series A startup funding.

In this article:

- 1. Series A Funding | Growth & Scaling for Startups

- 2. What Happens Before Series A funding?

- 3. Series A Funding | Main Challenges

- 4. Series A Funding | Main Types of Investors

- 5. Main Types of Investors | Venture Capital Firms in Series A Funding

- 6. How to Secure Series A Funding?

- 7. What Happens After Series A? (Series B & Beyond)

Series A Funding | Growth & Scaling for Startups

Funding rounds are a crucial part of a startup’s growth journey.

They play a key role in helping companies to grow. They also let companies raise venture capital financing from investors to fund development and expansion.

Each round marks a new stage – from seed to Series A, B, and C – with different goals and expectations. For founders, knowing how these rounds work is critical to building a strong funding strategy.

Series A Funding is meant for those who aim to accelerate their growth. Series A funding is crucial for ensuring that the company grows and expands its market reach.

At this stage, startups should apply only with a proven product-market fit and some revenue history.

Unlike the earlier funding stages, which focus on testing the business model in practice, Series A is all about scaling it and achieving sustainable growth.

Valuations and share prices during Series A funding are derived from various important factors, including market potential and revenue history.

Reaching series A funding is a tremendous milestone for any startup.

Similar to seed financing, series A financing is a type of equity-based financing. Why is it called Series A funding?

The first round after the seed stage is Series A funding. The term gets its name from the preferred stock sold to investors at this stage.

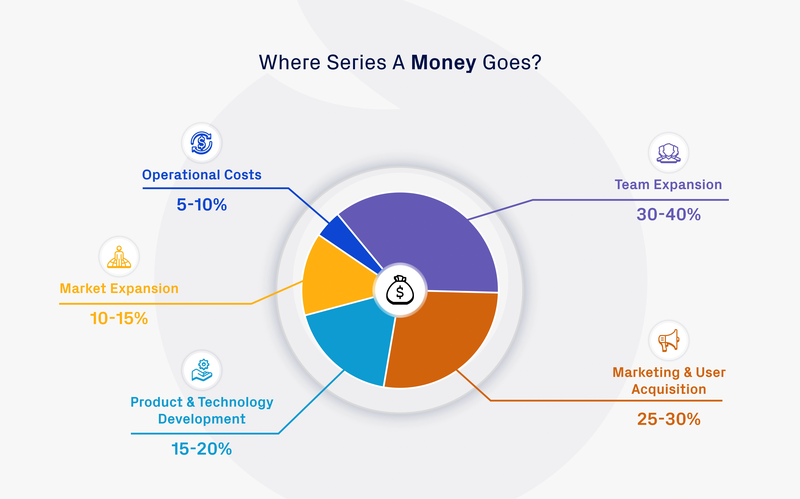

What is the Purpose of Series A Funding?

- Scaling the product & market reach – Expand user base & enter new markets,

- Monetization & business model optimization – Strengthen revenue streams,

- Team Expansion – Hire more developers, marketers, and sales teams,

- Customer acquisition & marketing – Invest in branding, paid ads, and partnerships to focus on acquiring customers,

- Technology & infrastructure upgrades – Improve platform performance and security,

- Business development – Focus on scaling operations and preparing for future investments.

Business leaders must align their strategies with investor requirements to effectively utilize Series A funding.

Is Series A Funding Easy?

No – and that’s normal.

Many seed-stage companies never reach Series A. It’s called the “Series A crunch.” Even promising startups with seed money often stall before raising more capital.

In 2018, around 20–24% of seed-funded companies moved on to Series A within two years. By early 2024, that dropped to just 13% (Carta Q1 2024).

Equity crowdfunding is becoming a more common option, but traditional Series A still demands proof of market, strong metrics, and a compelling vision.

Series A Milestones

To raise Series A, you need more than a good pitch. Investors look for real signals – early success, a growing customer base, and a strong team. A company must show that it understands its market, has built the right solution, and can scale.

Key milestones often include:

- Clear product–market fit

- Repeatable customer acquisition

- Revenue growth

- Go-to-market traction

- A solid founding team

These are all critical to showing potential investors that your company is ready for the next stage.

What Happens Before Series A funding?

Series A is the next round of funding after the seed funding.

By this point, a startup probably has a working product or service. And it likely has a few employees. Startups can raise an additional round of funding in return for preferred stock.

Pre-Seed Funding

Pre-seed funding is the first step. It usually comes from the founding team, friends and family, or early angel investors. The goal is to develop a basic version of the product, test the business idea, and prepare for the seed stage.

At this point, there’s little or no revenue. Founders use this capital to build a prototype, research the market opportunity, and define their value proposition. Pre-seed money sets the base for future funding rounds.

Seed Funding

Seed funding helps a company move from idea to early traction. This is where many startups prove product-market fit, build a team, and begin customer acquisition.

Seed capital is often used to test revenue streams, improve the go-to-market strategy, and prepare for raising Series A. Investors expect the business model to show promise and early revenue growth. A strong team and early success can also attract other investors.

Which Is Better: Series A or B?

Series B isn’t necessarily “better” than Series A – it just serves a different purpose following the initial investment. Series B funding is often pursued to raise more capital for scaling operations.

Series A focuses on product-market fit and early growth acceleration. Series B and later rounds are more about scaling an already proven and trusted business model.

These later rounds are crucial for expanding market reach, increasing revenue, and facilitating business development, as investors typically join in during these stages to support growth and scalability.

Series A funding is no longer considered the first substantial round of financing, as seed rounds have become larger.

The right round for your startup depends on its current stage and funding needs.

Series A and Beyond

Series A funding is a key milestone for any startup.

A funding round is when a company raises money from investors to support its growth and development. It usually means the company has found a market and is ready to scale operations.

At this stage, venture capitalists look for clear demand, a working product, and signs of sustainable growth.

Series B funding focuses on expansion – growing the customer base, entering new markets, and refining operations. It often involves hundreds of millions raised from venture capital firms, private equity firms, or even hedge funds.

Series C funding supports further expansion, acquisitions, or preparation for an initial public offering. These companies often have existing investors and strong revenue growth.

New investors – including investment banks – come in for a significant portion of the company’s shares.

Interested in a bird's-eye perspective?

Click here to read our main article on Startup Funding Rounds >

Series A Funding | Main Challenges

Raising Series A funding comes with several challenges that most investors believe startups must overcome. Startups must compete with other investors to secure Series A funding.

Most VC investors require strong growth metrics and a clear path to expansion before committing funds.

Additionally, during the Series A funding, you are always faced with a highly competitive market, where existing investors often play a critical role. Many startups struggle here to differentiate themselves and prove their unique value proposition.

Another vital challenge during this phase is high valuation expectations. Series A investors have high investor expectations for growth and scalability.

They typically look for startups valued between $20 million and $100 million or more. Understanding and managing risk is crucial for startups to meet investor expectations and succeed in a competitive market.

In short, the main pillars of Series A success are:

- Proven traction,

- Strong revenue potential,

- Market expansion capabilities.

This is what separates high-growth companies from those that struggle to scale.

Once funding is secured, there is immense pressure to deliver fast growth, with investors expecting rapid scaling and significant traction for further expansion to justify their investment.

How Many Companies Fail After Series A?

About 35% of startups fail between Series A and Series B. Even after raising capital, many hit roadblocks – from market fit issues to slow revenue growth. That’s why investor expectations stay high. Most venture capital firms want signs of traction and a clear path to scaling operations before committing more capital.

Existing investors often reinvest to keep their equity stake and influence. Series A rounds typically bring in $500,000 to $3 million, meant to fund 12–18 months of business development and early growth.

📌 Tip: Many startups fail at Series A because they lack clear revenue models or scalable customer acquisition strategies.

Series A Funding | Main Types of Investors

How Much Equity Is Given Up?

Most startups give up around 20% equity in each round from pre-seed to Series A. Selling more than 25% in a single round is uncommon – it can limit your control and options in future funding rounds.

Founders need to balance raising capital with keeping enough ownership to guide the long-term vision.

Founder Ownership After Series A

Ownership drops fast in early rounds. After seed funding, founding teams typically hold about 56% of their company. At Series A, that drops to around 36%. By Series B, it can fall to 23%. This dilution is normal – the tradeoff for bringing in capital and experienced investors.

Market Demand and Competition

Investors need more than a good idea – they want proof there’s market demand. That means showing the size of the market, a solid go-to-market strategy, and how your business stands out. Competitive advantage and value proposition are key here.

Venture capitalists and private equity firms look for startups that understand their customers, know the competitive landscape, and can prove they’re in the right market. These details influence valuation, shares, and whether you can raise more capital.

What Is Series A Funding?

Do Founders Get Paid?

Yes – but it starts small. At pre-seed, founder salaries are usually around $50K. That jumps to $100K at seed and can reach $150K or more at Series A. Founders often start with little to no salary until raising external capital. Series A funding helps create stability so the team can focus fully on growth.

What Do Series A CEOs Earn?

In 2025, Series A CEOs are earning around $203,000 on average, up from $179,000 in 2024. CEO pay varies by company size, industry, and location, but it typically reflects progress, funding stage, and investor expectations.

Main Types of Investors | Venture Capital Firms in Series A Funding

Series A funding round mainly attracts venture capital (VC) firms. Startups must strategically plan to raise Series A funding to attract venture capital firms. They are institutional investors providing large funding rounds to help startups scale.

Series A investors typically receive an equity stake in the company’s growth, which incentivizes them to support the startup’s development.

Corporate investors also participate in this stage, focusing on startups that align with their strategic interests and industry focus.

While angel investors typically invest in earlier stages, some late-stage angel investors do join Series A rounds if they see strong potential. It is worth noting that Private equity (PE) firms may also occur in Series A.

Some of the top VC firms known for Series A funding include Sequoia Capital, Andreessen Horowitz (a16z), Accel, Benchmark Capital, and Index Ventures, all of which have backed numerous successful startups.

📌 Example: Instagram raised a $7M Series A from Benchmark Capital to scale before being acquired by Facebook. Airbnb raised a $7.2M Series A from Sequoia Capital after proving demand in the short-term rental market.

Can anyone invest in Series A?

Series A funding typically comes from professional investors like hedge funds, angel investors, and venture capitalists.

While seed capital often comes from friends and family, Series A funding typically involves professional investors.

Since the investment amounts are high, family and friends rarely invest in Series A funding.

What Revenue Do You Need for Series A?

Investors expect to see revenue by Series A – usually in the $2M–$5M ARR range. But the growth rate and market potential matter more than hitting a specific number.

They’re backing a business model that shows early success and the potential for sustainable growth.

How to Secure Series A Funding?

- Show strong revenue & traction – Show increasing revenue, user engagement, and retention

- Present a clear business model & monetization – Investors want startups with proven revenue streams

- Show scalability potential – Demonstrate how the startup can grow 10x+. Demonstrating how the company grows and scales is crucial for securing Series A funding.

- Expose experienced team – Investors look for a strong leadership team that can execute growth

- Network with top VC firms – Use warm introductions, pitch competitions, and LinkedIn outreach

- Emphasize the role of the startup founder – Successfully securing Series A funding requires the startup founder to navigate investor expectations and demonstrate strong leadership skills.

Business Model and Product–Market Fit

Investors want clarity. That means a business model that works, and product–market fit that’s backed by real customer feedback. Venture capital firms, angel investors, and institutional investors all look for companies with a clear value proposition, strong competitive advantage, and a realistic path to revenue growth.

Before raising capital, founders should pressure-test their idea. Does the model scale? Is the customer base growing? Are revenue streams reliable? Market research helps you answer those questions and refine both your model and go-to-market strategy. Without these basics, even a good product won’t secure funding.

Go-to-Market Strategy

A strong go-to-market strategy shows how you’ll attract customers and grow. It’s not just a slide in a pitch deck – it’s how you build trust with investors. They want to see how you’ll expand your customer base, gain market share, and build sustainable growth.

This strategy should cover market research, competitive landscape, customer acquisition plans, and expected revenue streams. For Series A funding, in particular, venture capitalists expect more than a plan – they want to see traction.

Benefits of Series A Funding

Raising Series A gives your startup more than just capital. It brings access to expert support, investor networks, and momentum. With Series A funding, startups can scale operations, improve their business model, and enter new markets.

Institutional investors and venture capital firms also help refine your product–market fit and improve your long-term strategy. Term sheets at this stage define the equity stake, governance terms, and key conditions for future funding rounds.

What Happens After Series A? (Series B & Beyond)

| 📉 If fails: | 🚀 If successful: |

| The startup may struggle to raise Series B, pivot, or shut down if unable to scale. | The startup uses Series A funding to grow aggressively and attract Series B funding ($15M – $50M+). |

Click here to move on to Series B Funding Round >

![[August'25 Update] Top Free AI Models for Business | Automation and LLM's in 2025](/media/images/Img_1.format-png.width-72.webpquality-90.png)